ISG RegPRO

CIMS/ADF - RBI Reporting Tool

RBI Reporting Solution

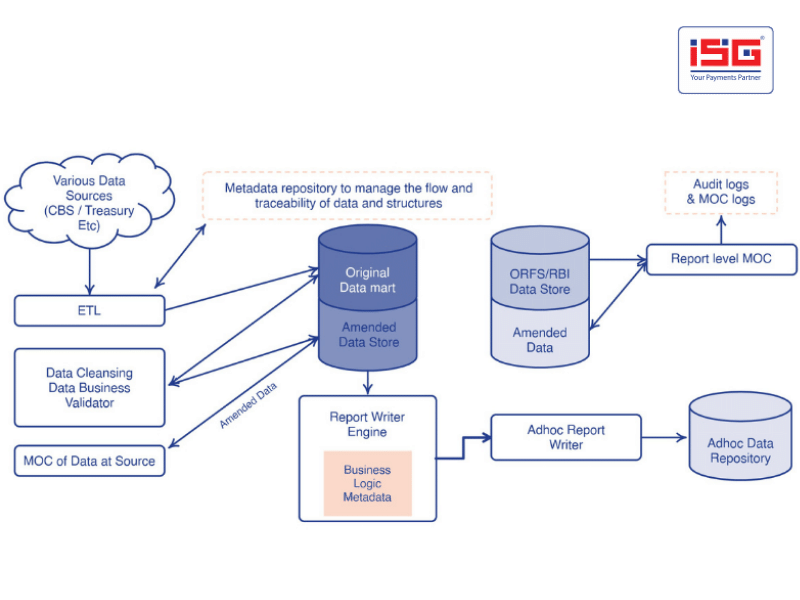

The second important component of ISG GBIS is the Centralised Information and Management System (CIMS) and Automated Data Flow (ADF) Environment.

RBI has set up Centralised Information and Management System (CIMS) for Automated Data Flow (ADF) to handle the bulging data collection from financial institutions in India. ISG’s CIMS Solution is developed to help banks in setting up CDR and generating audited returns from a single repository for statutory filing. It’s an industry-proven data model design for CIMS and ISG brings in efficient data management and data quality management with its CIMS solution. It is built on

RBI Reporting Framework

CDR

Single source of truth that is used for generating the Centralized DCR Regulatory returns and internal report requirements.

Automated ETL

It enables banks to pull data from various sources with multiple industry standards and enables automated data flow with zero manual intervention

XBRL Engine

ISG RegPRO for RBI Reporting

ISG’s CIMS Solution provides an end-to-end Regulatory Report Solution to enable timely and accurate data flow across stages. It works in sync with RBI’s Staging Area Data Portal (SADP) for staging all the RBI reports. Moreover, it provides integrated data validations with the CISLA code validation, hence building the report accuracy at a granular level.

ISG's RegPRO - CIMS/ADF Solution

It has various prebuilt dashboards and customizable KPIs in-built for banks. ISG continuously monitors the regulatory report changes and updates the software to keep the bank up to date on the regulatory filing and ensure compliance on the same.