3DS ACS

Issuing Side Security For CNP Transactions

Why does 3DS matter?

3D Secure

3DS enhances the checkout experience, providing increased security for both consumers and merchants. Serving as a form of multifactor authentication, 3DS effectively reduces both fraudulent charges and the resulting chargebacks. Moreover, when merchants adopt 3-D Secure, the liability for fraudulent chargebacks is transferred to the issuing bank. This is particularly beneficial, as chargebacks can incur substantial fees, nearly doubling the original transaction amount.

However, it’s important to note that 3DS introduces an additional step in the payment process, potentially contributing to higher cart abandonment rates. For businesses with higher chargeback rates, this trade-off is often worthwhile. On the other hand, streamlined payments may be more cost-effective for certain businesses in the long run.

Access Control Server

Role of ACS

In the dynamic realm of online transactions, the Access Control Server (ACS) stands as the vanguard for cardholder authentication. The Access Control Server (ACS) resides within the issuing bank’s domain. The issuing bank, responsible for the card the cardholder is using, plays a vital role in authenticating whether the card is associated with the authorized cardholder.

Diverse Authentication Methods

The ACS ensures flexibility in authentication methods, utilizing either one-time codes or account login procedures. This adaptability allows for a tailored approach, catering to the diverse needs and preferences of cardholders.

The Mandatory Role of Card Issuers

Every card issuer is mandated to maintain an Access Control Server, emphasizing the critical role it plays in the 3D Secure ecosystem. Compliance with industry standards ensures that the cardholder authentication process is not just a necessity but a robust and secure practice.

The Process

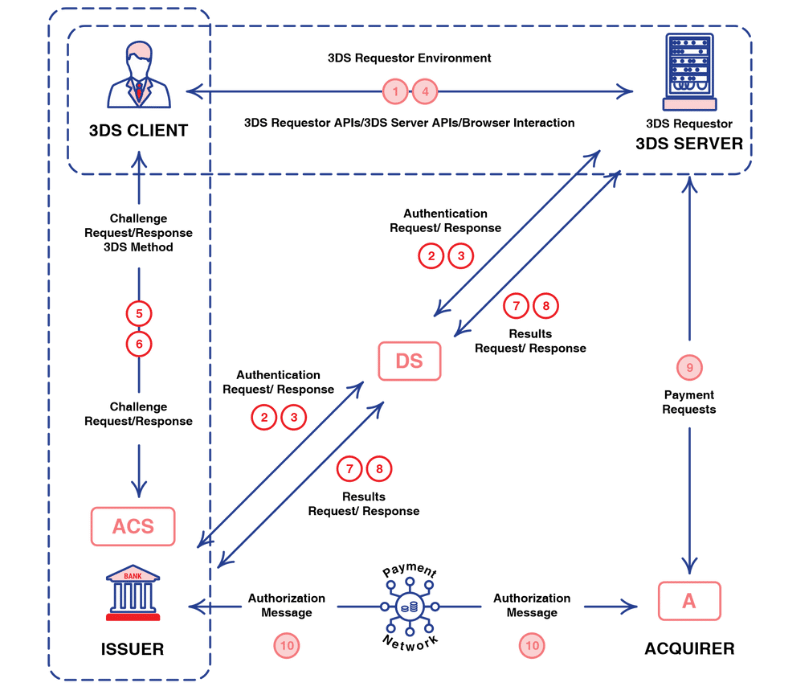

When an Authentication Request is received, the ACS takes charge, employing either a challenge flow or a frictionless flow to verify the legitimacy of the transaction.

Customers then verify their identity by providing information such as their account password or a code sent to their email or phone to the ACS.

By comparing this information with the records available to the issuing bank, the ACS signals whether the customer has successfully verified their identity.

Scheme Compliant 3DS ACS: For Issuers

The ISG 3DS ACS holds certifications and is compatible with major card schemes. Moreover, our solution strictly adheres to PCI DSS and PCI 3DS compliance standards, guaranteeing the utmost security for your online transactions.

In the ever-evolving landscape of online security, the ISG’s 3DS ACS stands as a stalwart companion, empowering issuer banks to navigate the complexities of cardholder authentication with precision and confidence. Elevate your commitment to security and compliance – choose ISG’s Genius 3DS ACS for a robust 3D Secure experience.

Explore the 3DSS too!

To take advantage of the added security offered by 3DS, explore the 3DS Server designed to integrate multifactor authentication for your transactions